BIG TECH Navigating the Sector’s Climate Imperative: A Call for Transparency and Strategic Disclosure

Audio Summary HERE [19:39 Mins]

The global economy is rapidly decarbonising, driven by increasing pressure from consumers, shareholders, regulators and employees for companies to address climate change. In this evolving landscape, distinguishing genuine climate leadership from unsubstantiated greenwashing has become a critical challenge. For the technology sector, this challenge is particularly acute, as soaring energy demands and outdated reporting methodologies are creating a “climate strategy crisis”.

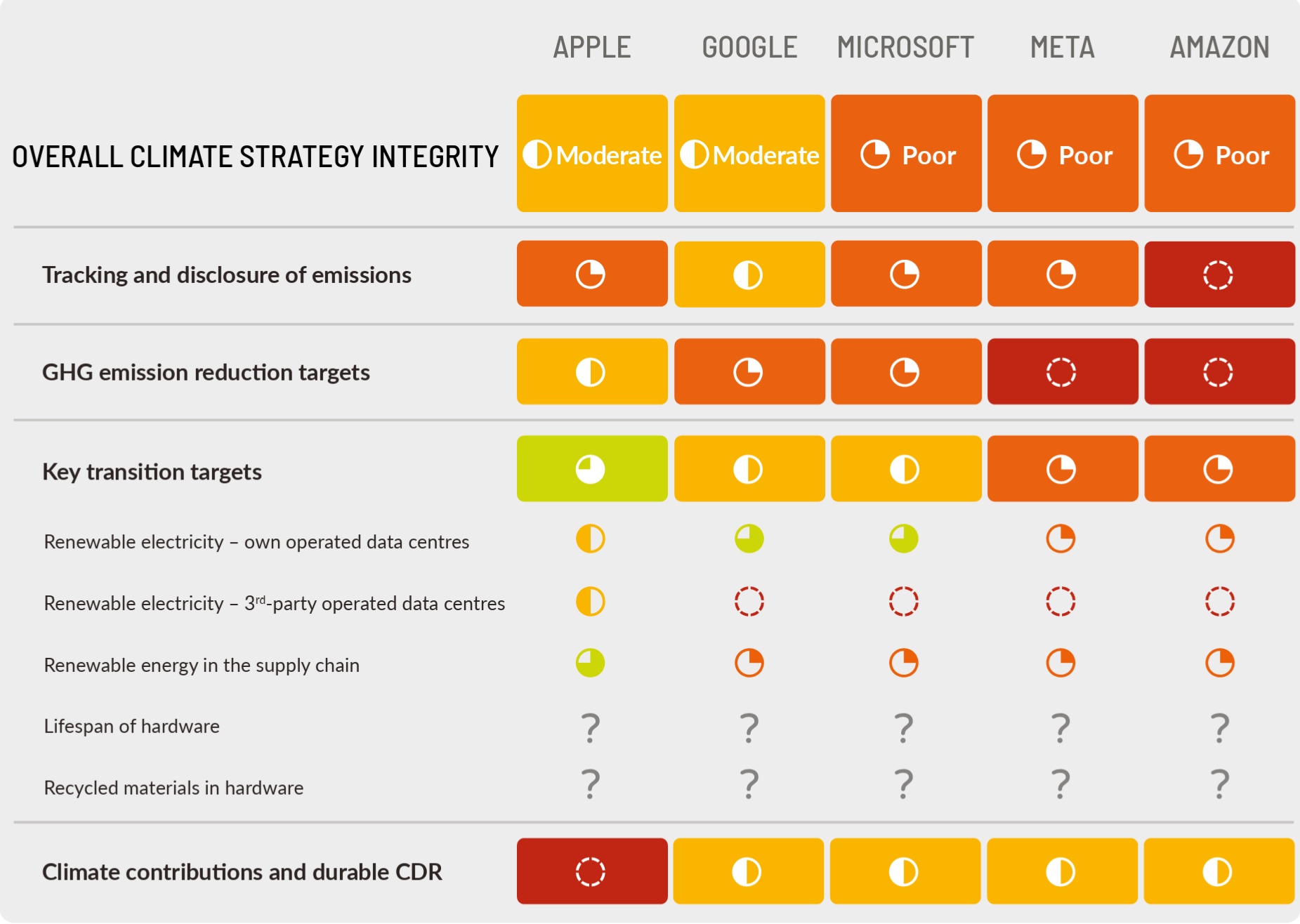

Source Corporate Climate Responsibility Monitor (CCRM) 2025

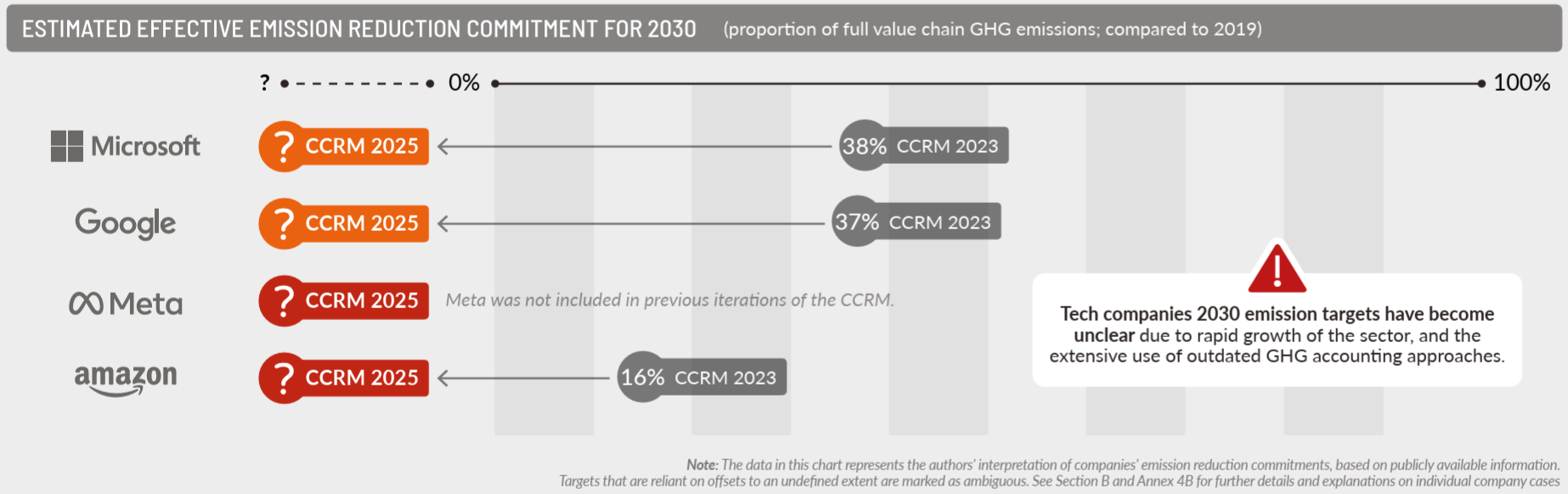

The Corporate Climate Responsibility Monitor (CCRM) 2025 highlights that many tech companies’ greenhouse gas (GHG) emission targets appear to have lost their meaning amid the rapid expansion of Artificial Intelligence (AI) and increasing energy consumption. This situation necessitates a fundamental rethink of corporate climate strategies, with a stronger emphasis on transparent and transition-specific non-financial climate disclosures.

The Tech Sector’s Emissions Landscape: More Than Meets the Eye

The majority of the tech sector’s emissions footprint stems from two primary sources: electricity use in data centres and energy consumption for hardware production upstream. Data centres, in particular, require significant computing power, and their electricity use is projected to double between 2024 and 2030 due to the mainstreaming of AI. This unconstrained growth in energy consumption risks undermining existing climate pledges.

Big Tech Climate Commitments Going Backwards 2023 > 2025 Source Corporate Climate Responsibility Monitor (CCRM) 2025

A significant issue identified in the CCRM 2025 is the reliance on outdated market-based accounting methodologies for Scope 2 and, often, Scope 3 emissions. While market-based accounting allows companies to claim GHG reductions through renewable energy certificates (RECs), their actual location-based emissions may not decrease at all. For instance, Apple’s location-based emissions are approximately three times higher than its reported market-based emissions, and Amazon uses its own unconventional methods for market-based Scope 3 calculations, potentially leading to misleading reduction trends.

Furthermore, there is a significant lack of transparency regarding emissions from third-party operated data centres, which could represent a major accounting loophole. None of the major tech companies assessed report on the extent or emissions footprint of these outsourced services, obscuring a potentially large source of their climate impact.

Shifting to Robust Non-Financial Climate Disclosures: The Path Forward

Given these challenges, the CCRM 2025 strongly advocates for a shift from relying solely on broad GHG emission reduction targets to incorporating transition-specific alignment targets. These are metrics that directly reflect a company’s progress on critical decarbonisation milestones within its sector, providing a more accurate and actionable guide for climate strategies.

For the tech sector, key transition-specific alignment targets include:

Increasing renewable electricity procurement for data centres, with an emphasis on hourly matching (24/7 carbon-free energy) over annual matching, to directly reduce reliance on fossil fuels. Companies like Google and Microsoft are leading efforts in this area.

Expanding renewable electricity in the supply chain for hardware manufacturing, which accounts for at least a third of most tech companies’ emissions. Apple, for example, has a specific target for 100% clean electricity throughout its value chain by 2030, supported by supplier engagement programs and Power Purchase Agreements (PPAs).

Extending the lifespan of devices and hardware, as the majority of emissions from electronic devices occur during production. While all five tech companies assessed describe measures for repairability and longevity, specific targets are generally lacking.

Increasing the use of recycled components in hardware manufacturing, to address the energy-intensive mining of critical minerals. Apple, Google, and Microsoft have set various targets in this area, though harmonised guidance is needed.

Mandatory Reporting: A New Era of Accountability

Governments worldwide are introducing mandatory climate reporting to drive greater accountability. In Australia, for instance, the mandatory climate reporting regime, legislated in September 2024, will begin from 1 January 2025 for the largest emitters and corporations. This regime requires entities to disclose their climate-related risks and opportunities in a mandated ‘Sustainability Report’, which will form a critical part of their Annual Report.

These new Australian disclosures, based on the AASB S2 standard (an adaptation of the international IFRS S2), build upon the Task Force on Climate-related Financial Disclosures (TCFD) framework but demand more detailed and quantitative disclosures. Key non-financial climate disclosures required under AASB S2 include:

Governance: Details of board oversight, management’s role in assessing climate risks and opportunities, and how these responsibilities are embedded in organisational structures.

Strategy and Risk Management: Disclosure of any transition plans to achieve climate targets, the current and anticipated effects of climate-related risks and opportunities on business models and value chains, and quantitative information on financial impacts (e.g., cash flows, asset values). This also mandates assessing climate resilience through scenario analysis, including at least two scenarios (1.5°C warming and “well exceeds” 2°C).

Metrics and Targets: This is where the non-financial disclosures become most granular. Companies must disclose Scope 1, Scope 2, and Scope 3 Greenhouse Gas (GHG) emissions. Scope 3 emissions, which encompass all indirect emissions in the value chain, will be mandatory from an entity’s second reporting year. Other metrics include the percentage of executive remuneration linked to climate considerations and internal carbon prices.

Directors are expected to exercise due care and diligence in overseeing the robustness of corporate reporting systems and processes, as they are generally accountable for public disclosures. Importantly, the regime includes a “Modified Liability Period” for certain forward-looking statements and Scope 3 disclosures, aiming to encourage fulsome disclosure in areas with high measurement or outcome uncertainty. Companies are warned against “greenhushing” — minimizing disclosures — as it can lead to poor commercial and legal outcomes.

Recommendations for Enterprise Leadership

To navigate this complex but critical shift, enterprises, particularly in the tech sector, should:

Rethink GHG and Renewable Electricity Targets: Set both location-based emissions targets and 24/7 renewable electricity procurement targets to ensure clarity and incentivise deep decarbonisation.

Enhance Transparency on Energy and Growth Challenges: Communicate transparently about the climate impact of AI growth and data centre energy demand, advocating for responsible AI development.

Report on Third-Party Operated Data Centres: Disclose location-based emissions from third-party data centres to provide a comprehensive view of climate impact and avoid misleading impressions.

Set Clear Supply Chain Renewable Electricity Targets: Establish specific targets for renewable electricity in the supply chain, considering the entire electricity consumption of suppliers.

Advocate for Hardware Lifespan and Recycling Guidance: Engage with policymakers and standard setters to develop clear guidance and regulations on increasing hardware longevity and recycled components.

Address Platform-Based Business Model Impacts: Be transparent about the climate impact of platform-based business models (e.g., advertising services) and consider measures to address them.

The evolution of corporate accountability standards presents a pivotal opportunity to drive meaningful climate action. By embracing robust, transparent, and transition-focused non-financial climate disclosures, tech enterprises can not only meet regulatory expectations but also solidify their position as genuine climate leaders in a rapidly changing world.

References

[Carbon Market Watch] Corporate Climate Responsibility Monitor (CCRM) 2025

[Australian Institute of Company Directors] A director’s guide to mandatory climate reporting

[Climate Group] 24/7 Carbon Free Electricity & 24/7 Carbon-Free Coalition

[Ketan Joshi Climate and energy] The life and death of Microsoft’s Moonshot

[Ketan Joshi Climate and energy] Big tech’s selective disclosure masks AI’s real climate impact